Paymate to Protractor - Payroll Postings

Paymate is proud to partner with Protractor to provide comprehensive payroll solutions to its Canadian customers.

This document covers the process of setting up the integration between Acclaim Payroll and the Protractor Shop Management software. Although not embedded into Protractor, by setting up the interface you will be able to import GL (General Ledger) entries into Protractor avoiding the need to manually re-enter them.

What you’ll find:

- How does Paymate Acclaim work with Protractor?

- Is there anything special to do when setting up Protractor?

- Is there anything special to do when setting up Paymate?

- How do I import the transactions into Protractor?

- GL Mapping in Paymate (one –time task)

- Exporting Payroll Transactions from Paymate

- Posting Date

- Description

- Getting the Money Out of the Bank

- Importing Payroll Postings into Protractor

- Who do I call when I have payroll questions?

- Who do I call when I have questions after importing payroll transactions into Protractor?

How does Paymate Acclaim work with Protractor?

Paymate Acclaim has the ability to export payroll transactions to a file and Protractor has the ability to import payroll export files into the General Ledger. Protractor will recognize this format from Paymate.

The Standard G/L Detail format is a detailed journal entry of your payroll (within the given range of dates exported).

Is there anything special to do when setting up Protractor?

Many Protractor users do not have their GL numbers setup to their accounts in Protractor. It would be very cumbersome to use account descriptions every time an entry has to be logged. Therefore accounting involves using a chart of accounts. The number becomes the abbreviation for the description. You will need to assign a GL numbers to each account (at least payroll related) in order to be able to interface a Payroll system. You will need to establish a set of GL numbers for any accounts that interface to payroll accounts. To do this in Protractor, simply right click on the Account>Edit Account and add the account#.

Is there anything special to do when setting up Paymate?

You must enter the corresponding account numbers from Protractor into the Departments and Accounts section of Acclaim. This Protractor related setup pertains to the GL codes that will be associated to the earning, deduction codes, etc. These GL codes must match up with the corresponding GL codes in your Protractor system. If the GL codes are invalid, you will receive error messages/notice the red areas that need attention at the time of importing the transactions into Protractor. See further in this document for more details on setting up GL codes.

How do I import the transactions into Protractor?

First you will export payroll transactions from Paymate. A file is created based on ranges of dates that you choose, format of the export, etc. This file is saved to a place of your choosing. This file is then imported from within Protractor using the ‘Import Payroll Transactions’ option. If there are problems with this file, warnings will be displayed.

Branches/Departments

If your company has multiple branches and you have created separate departments in Paymate for each branch, you can indicate a branch on the Paymate side by including the branch# in with the GL account specified under that department in Paymate. For example, 61170-1 would be used in Paymate to indicate that the posting would go to 61170 Protractor GL Location 1 and 61170-2 would be used in Paymate to indicate that the posting would go to 61170 Protractor GL Location 2, etc. The branch code is only applicable for those GL accounts that are reported on a Profit & Loss/Income statement (accounts starting with 4, 5 or 6).

GL Mapping in Paymate (one –time task)

The GL Accounts must be specified within Paymate for the import into Protractor to work properly. Note In Paymate, GL Accounts are specified per ‘department’. You have the option of setting up multiple departments within Paymate, or you can run with one department for your entire company (see the Paymate help / knowledgebase for more details about departments within Paymate). For each department within Paymate, you can and must specify the GL Accounts that will be used for the various earnings, deductions, accruals, etc.

Found in Setup > Departments & Accounts, the following screen shot represents a subset of accounts setup for a company-wide department. The example accounts shown are typical for the various expenses, accruals, and payables involved in running a payroll.

Setup > Departments & Accounts

NOTE: The software will not produce an export file if there are missing account numbers.

Exporting Payroll Transactions from Paymate

Postings need to be exported from Paymate before they can be imported into Protractor

In Paymate, navigate to Payroll > Export Payroll.

Choose Standard G/L Detail as your accounting package selection which is supported by Protractor.

Next, specify the Parameters of the export.

Note Care should be taken when choosing the ranges of dates as the system will not be able to tell if you have ‘doubled up’ on ranges of dates.

Batch Date: This is the date that you want to hit the GL. It will default to the current date so be careful which month you want this to be in.

On the Preferences Tab select the Application of Date Range, the Date Format and where the export file will be saved.

Make note of where the export file location and name of the file. You’ll need to know in order to import it into Protractor.

Click on Export and the file will be generated.

Posting Date

The Posting Date may or may not match with the batch date on the imported file. This date cannot be in the future. The payroll postings generated in Protractor will have this date.

Description

This is the detailed Description of the Journal Entry that will show in reports. There could also be line by line descriptions in the Journal Entry that come directly from the imported file (like Employee Name when using a detailed layout).

Getting the Money Out of the Bank

If you’ve mapped Paymate’s Net Pay field to a Wages Payble Protractor GL (instead of directly to a bank account), once the payroll postings have been imported, Wages Payable needs to translate into actual funds coming out of the bank. One way to do this is with a direct deposit transaction invoice with your bank as the supplier, and postings going to wages payable. Then the payment your bank (ie CIBC, BMO, RBC etc) happens with the posting going to the bank account related to the payment type selected.

You could also create a Journal Entry to manually move the funds where you want them to go.

Importing Payroll Postings into Protractor

Now that you’ve got an export file containing the payroll postings, you can import them into Protractor.

In Protractor, go to the General Ledger and use the ‘Import’ feature to import the file created in Acclaim Payroll.

Choose the Paymate Payroll Import in from the Import Format selector at the top

Go Next then it will let you browse for your Import file from Paymate

On the Open window, select the File name of the export (it’ll be the same file type you selected when you exported the postings from Paymate).. Navigate to where Paymate exported the file, select it, and click Open. Once the file is opened, it will be validated. Protractor will ensure that it matches the chosen file type and that here are valid transactions within the file. If there is a field that is highlighted in RED, then likely there is an issue.

If your file is clean with no Red errors, then review and hit Next.

Hit start to begin the import.

Select ‘Close’ once completed and this has now updated to your G/L in Protractor.

Who do I call when I have payroll questions?

Paymate’s annual maintenance fee includes support for questions about their software. You can call 1-905-771-1155 or email support at support@paymatesoftware.com

Who do I call when I have questions after importing payroll transactions into Protractor?

For all Protractor procedural questions, please contact Protractor Systems.

1 Comment

Paymate Support (Second Level)

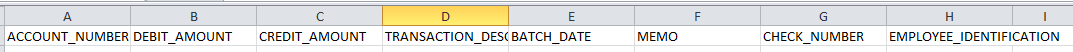

Columns exported into the .csv file .

The exported file will include following columns:

ACCOUNT_NUMBER

DEBIT_AMOUNT

CREDIT_AMOUNT

TRANSACTION_DESCRIPTION

BATCH_DATE

MEMO

CHECK_NUMBER

EMPLOYEE_IDENTIFICATION